Investing basically means lending out your money, and getting some kind of return on it.

Investing basically means lending out your money, and getting some kind of return on it.

There’s two kinds of investments: debt and equity. With debt, you lend the money and get a fixed rate of interest. With equity, you buy a small slice of a business and get a share of its earnings. Typically the business will pay out some of its earnings as a cash dividend and reinvest the rest to expand its business (for example, by adding more stores), causing its value to grow.

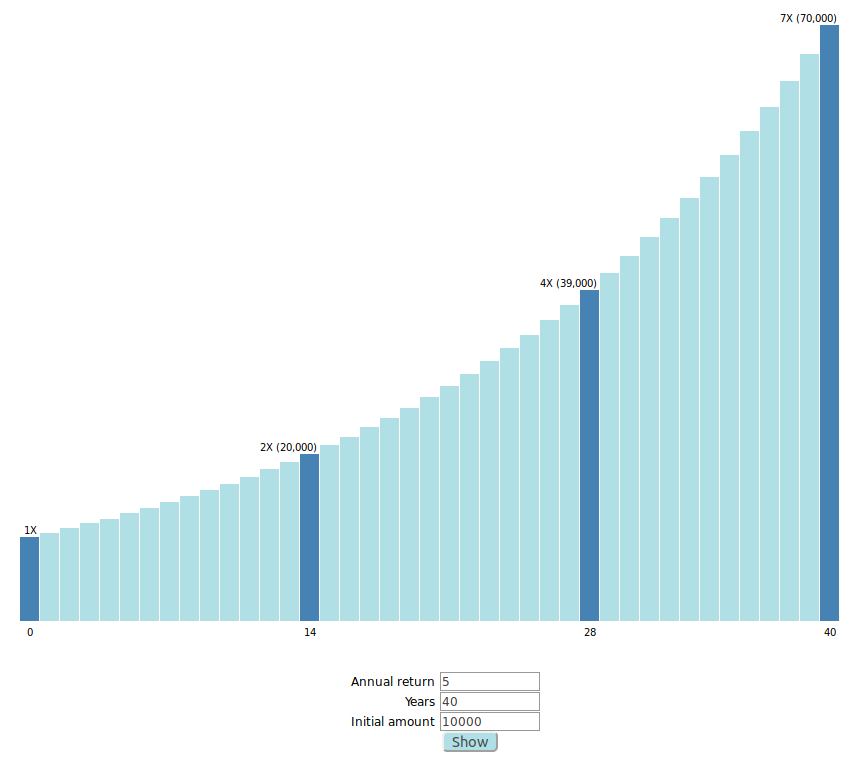

Either way, the value of your investment compounds over time. The rule of 72 says that if your annual return is x%, then it takes about 72 / x years for your money to double. At 5%, for example, it doubles every 14 years or so. So if you can invest $10,000 at 5% and not touch it for the next 40 years, it’ll double a bit less than three times, increasing to $70,000.

Equity investments are volatile: they go up and down. So investors aren’t willing to pay as much as for debt investments, resulting in a higher return on equities. In the long term, equity investments grow faster than debt investments. You take a higher risk and get a higher return.

There's different approaches to investing in equities:

-

Stock picking - you look for companies which you think are undervalued, i.e. selling for less than they're worth, and buy their shares.

-

Buy a mutual fund - a mutual fund is run by a manager who actively decides what companies to invest in, spreading your investment over a larger number of companies. Charges an annual fee of 1-2%.

-

Buy an index fund - an index fund has much lower fees (0.25% or less), because you just buy a small slice of all companies in the stock market ("passive investing"). There's no need to pay a manager and their staff to look at each company and decide whether it's undervalued or not.

A common approach is to keep your costs low by just buying index funds. Stock picking is hard: it's like trying to find a diamond in a field that's already been searched by an army of professionals. With mutual funds, you’re paying a lot. When your expected average annual return is around 5%, 1-2% is a big chunk. And because stock picking is hard, mutual fund managers have a very hard time doing better than average.

Index funds are liquid (you can sell them easily), diversified (you’re not going to lose all your money if a single company or a single economic sector does badly), and scalable (unlike real estate, you can buy as much or as little as you want).

You probably don't want 100% of your retirement savings in equities, because they go up and down, which can be pretty hard to take. (You don’t want to panic and sell when they’re low.) A common recommendation is to keep 40% or 50% in bonds (interest-paying debt investments), which are less volatile, providing some stability and reassurance when the stock market is going through a meltdown.

For Canadians, the Vanguard Balanced ETF Portfolio fund, VBAL, is a simple, hands-off, low-cost way to keep your investments 60% in equities, 40% in bonds, with an annual management fee of 0.22%. (iShares and BMO also offer asset allocation funds. For Americans, the equivalent is the Vanguard LifeStrategy Moderate Growth fund.)

In retirement, you can generate cash from your investments by selling about 4% each year.

For a step-by-step guide, I'd recommend John Robertson's book The Value of Simple: A Practical Guide to Taking the Complexity out of Investing. For more details, see Dan Bortolotti's Canadian Couch Potato blog.